2017 has been a good year for crypto. Following Bitcoin’s steady rise to astronomical prices, altcoins saw healthy gains from their positions a year ago. Ethereum’s value increased 2,900% from November of last year. Litecoin grew a healthy 1,500% alongside Monero. Ripple tops off this list, gaining 3,185% over the year.

All of this to say, crytpo is starting to come to the fore of the global investment scene. More and more investing firms and banks are starting to speak out in favor of the new tech craze. With big money endorsements comes mainstream adoption from the general public. The popular cryptocurrency purchasing site Coinbase, for instance, added 100,000 users in only 24hrs in the beginning of November. Crypto is proving itself to be legit, both as a technological advancement and an investment. It’s no longer the obscure interest of tech-savvy visionaries.

But with growth comes obstacles, and one of those obstacles is accessibility. For the technologically literate, navigating the cryptosphere is simple enough, but for those less attuned to the intricacies of blockchain, currency exchanges, and wallets, the learning curve can be intimidating. Luckily, there are cryptocompanies designing currencies, platforms, and products that aim to make the crypto experience more accessible to your average user.

So which companies are they? Here are a few of our favorites below.

Iconomi

Iconomi is a digital assets management platform that wants to attract veteran and amateur crypto-investors alike. Identifying itself as a digital assets array (DAA), it claims to be the fourth generation of digital assets. As an asset array, it combines the previous three generations (i.e., Bitcoin as 1st, alt-coins as 2nd, and utility tokens as 3rd) into a unified asset.

Think of Iconomi as the NASDAQ or S&P500 of the cryptoworld. The platform offers a variety of index funds for investors to allocate their capital. The Conbest 1 (CBST), for example, offers investors a conservative, low volatility asset to stake their money. The index includes Bitcoin, a number of blockchain platforms (Ethereum, Waves, and WINGS), Bancor, and Aargon. There are also more diverse, higher risk portfolios that look to capitalize on undervalued coins within emerging sectors in the cryptosphere. The William Mougayar High Growth Cryptoassets Index (WMX), for instance, invests in high-growth potential coins like Augur, Game Credits, Civic, TenX, FunFair, and others, with Ethereum eating the majority of the fund’s investment.

Iconomi has the potential to attract investors who otherwise would not want to wrestle with crypto’s technological learning curve. With Iconomi, they can easily invest with the Iconomi token on its ease-of-use platform. Moreover, the index funds’ return rates may warm the cold feet of crypto skeptics. Coinbest 1 alone boasted a 35.20% return on investment over the past month. Somewhere, someone is questioning their NASDAQ’s utility.

Eidoo

On its website, Eidoo brands itself as a “blockchain-to-human interface,” and it doesn’t get any more clear cut than that, folks. The Eidoo team wants to humanize the cryptic aspects of crypto so no one has to watch from the sidelines.

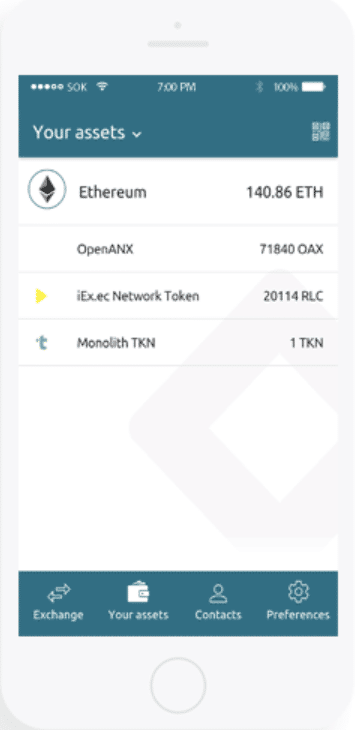

They plan to optimize a user-friendly experience by creating an all-in-one interface for the average user to adopt. If you’re new to crypto, the sea of wallets and exchanges you have to navigate to manage your assets can be intimidating. Eidoo wants to calm these waters by offering a single application that functions as a multi-currency wallet and hybrid exchange.

The wallet will accommodate Ethereum, Bitcoin, and ERC20 tokens, all protected

With the wallet downloaded, users can then use the wallet’s decentralized exchange function to trade Bitcoin, Ethereum, and ERC20 tokens. The exchange manager does not have access to user funds, so users can be arbiters of their own crypto fates without having to worry about third parties mismanaging their funds.

Eidoo’s single application usability could have great implications for mass adoption of cryptoassets. The platform’s roadmap expects the exchange to go live by Q3 of 2018, and they even have a debit card in the works for Q2 of 2018 as well. We’ll be keeping an eye on Eidoo, as we expect exciting things in the year to come.

Vertcoin

It calls itself “The People’s Coin,” a “decentralized currency owned by its users.” Vertcoin holds true to the original vision of Satoshi Nakamoto, Bitcoin’s pseudonymous founder. Like Bitcoin, it is designed as a peer-to-peer, decentralized digital currency that disavows the need for middle-men like banks and financial institutions.

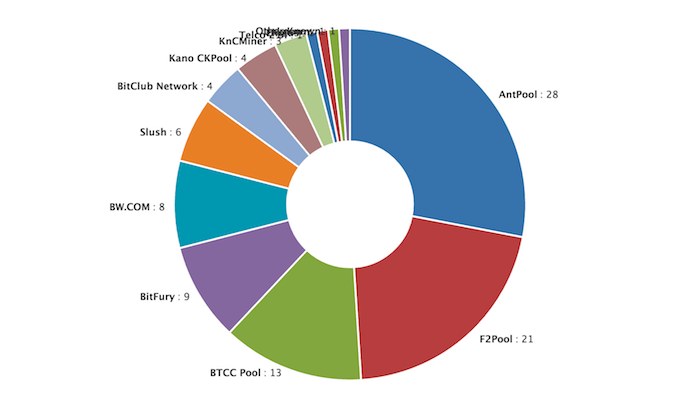

It’s also unlike Bitcoin in that it insulates itself from the de-facto centralization that mining pools have brought to Bitcoin core. Vertcoin is application-specific integrated circuit (ASIC) resistant. Without getting too hung up ASIC technology, ASIC rigs allowed for a more efficient mining process than its predecessors. As Bitcoin hash rates increased in difficulty, ASIC mining superseded GPUs, CPUs, and FPGAs as the primary method to process Bitcoin transactions. ASIC then grew more popular and groups of miners combined their rigs into mining pools. With this aggregated processing power came a disproportionate distribution of hashrate across the blockchain, and now 62% of Bitcoin’s mining power is split between 3 mining pools. Many argue that this creates an unintended centralization, as a majority of the blockchain is in the hands of a select few. It’s this same centralization that, in many respects, allowed for Bitcoin Cash’s attack on Bitcoin back in mid-November.

Vertcoin comes free of centralization and all the drama it may entail. The Lyra2RE(vs) algorithm it employs makes the coin resistant to ASIC mining. This insures that large mining rigs cannot compromise Vertcoin’s security or integrity, allowing for an even distribution of hashrate among users. Anyone with a powerful enough processor (CPU) or graphics card (GPU) can mine Vertcoin, and this process is made even easier with the coin’s 1-click miner. The 1-click miner streamlines the otherwise complex mining process, making even the more technical aspects of the crypto revolution accessible to everyone.

Final Thoughts

The list we’ve compiled doesn’t stop here–these were just a few noteworthy picks. There are more platforms that are looking to bring crypto fever to the general public, and we may even cover those a little bit later.

The takeaway from the emergence of such companies, however, is simple: what Satoshi Nakamoto started in 2009 is budding into a new technological reality. Technological improvements have given way to enterprise solutions and mainstream exposure, and from this exposure comes the demand to accommodate a public unacquainted with blockchain and its potential. The more popular crypto becomes, the more likely you’ll see these platforms and others like them gaining more traction, and as user-friendly platforms become more popular, crypto’s immanence only increases.

The revolution won’t be televised–it’s digitized, and it’s already in full swing.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.